The Truth About "Diversification": The Mental Fortress No Coach Ever Tells You

- Writer

- Oct 31, 2025

- 3 min read

In the investment world, saturated with success stories of people who got "rich quick" by going all-in on a single stock or crypto coin, the term "diversification" is often dismissed as a strategy for the fearful, the conservative, or those content with mediocre returns.

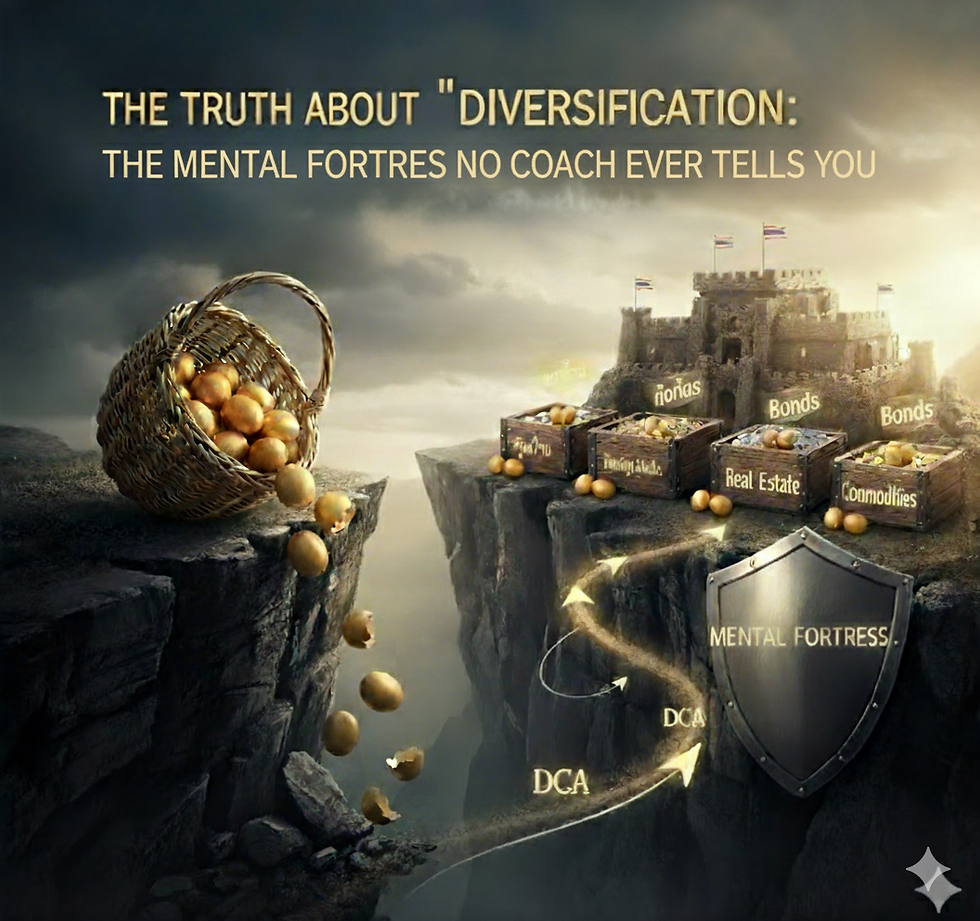

Here is the naked truth: Diversification is not a mathematical strategy; it is a psychological discipline. It is the ultimate shield built specifically to prevent you from committing financial suicide when the market turns against you.

Greed: The Enemy That Blinds You to Reality

Can you admit that every time you decided to throw a large chunk of money into a single asset, it wasn't driven by "accurate analysis," but by "surging greed"? You saw the potential for a 10x or 100x return and forgot the one absolute truth: nothing in the world of investment is permanent.

Greed instructs your brain to shut down the parts responsible for risk assessment. It lets you see only the potential gain, leaving you completely blind to the potential loss—the image of your portfolio hitting zero!

By refusing to diversify, you are playing a game where if you win, you get a large sum, but if you lose, you lose everything, along with your shattered mental health.

Diversification: Building the Mindset Fortress

The heart of diversification is the humble acceptance that "we don't know what the future holds." No investor in the world can predict with 100% accuracy which asset will soar and which will plunge.

Diversification is, therefore, your way of "showing humility to the market." It is the act of buying multiple tickets to ride, so that when one ticket is cancelled (an asset suffers a major loss), you still have other tickets to continue your journey.

Preventing the Mental Wipeout

When you concentrate all your capital in one place and it drops by 50% or 80%, the emotional impact is so severe that you are likely to make a colossal mistake, such as selling at the absolute bottom or giving up on investing altogether.

But if your money is spread across five baskets, the collapse of one basket leaves you with the clarity and composure to manage the remaining four.

Creating Consistency

Diversification provides consistency in your portfolio's growth—it might not be flashy, but it is steady. And "consistency" is the crucial key to maintaining a calm and sustainable investing mindset.

The Pain of Holding "Rotten Eggs"

Most unsuccessful investors get emotionally attached to their "rotten eggs" (assets with major losses), holding onto them with wishful thinking. They let these losing assets consume an ever-larger share of the portfolio until that single rotten egg destroys everything.

Having different asset types forces you to be "accountable" and to "regularly review" your decisions. When you diversify, you must be willing to cut the rotten eggs and shift capital to the strong baskets to preserve the overall portfolio structure.

Remember this: You didn't lose because the market was volatile; you lost because you gave up on yourself by clinging to something that was already dead.

The Way Forward: The Discipline of Admitting Ignorance

If you want to be an investor who survives and thrives long-term, you must view diversification as your "financial life insurance."

Diversify by Asset Class (The What): Hold not just stocks, but also bonds, real estate, commodities, or even cash. This ensures each type responds differently to various economic cycles.

Diversify by Geography (The Where): Invest beyond your home country into foreign markets. This shields you from internal political and domestic economic risks.

Diversify by Time (DCA - The When): Consistent, staggered investing (Dollar-Cost Averaging) is a high form of psychological discipline. It removes the pressure of trying to "time the market," a feat no one has successfully achieved long-term.

Stop playing the all-or-nothing game. Diversification is your declaration that you are ready to accept reasonable, sustainable profits instead of chasing fleeting, fast wealth. This approach will not only preserve your capital but, more importantly, safeguard your "Mindset" and "Emotional Calm," which are the most valuable assets in long-term investing.

Comments